Hakan Eryılmaz, CEO, Lydia Investing Holding, “Capital Markets in Turkey”

Tag Archives: SIAM

METU-SIAM STUDENT CHAPTER SEMINAR-27

Hakan Eryılmaz, CEO, Lydia Investing Holding, “Capital Markets in Turkey”

Date: May 23, 2023

Time: 15:30-16:30

Venue: Institute of Applied Mathematics (IAM), Hayri Körezlioğlu Seminar Room (S-212)

METU-SIAM STUDENT CHAPTER SEMINAR SERIES-26

Gerhard Wilhelm Weber, Poznan University of Technology, “Regime-Switching Models via Stochastic Optimal Control & Robust Control Theory, with applications in Finance and Insurance”

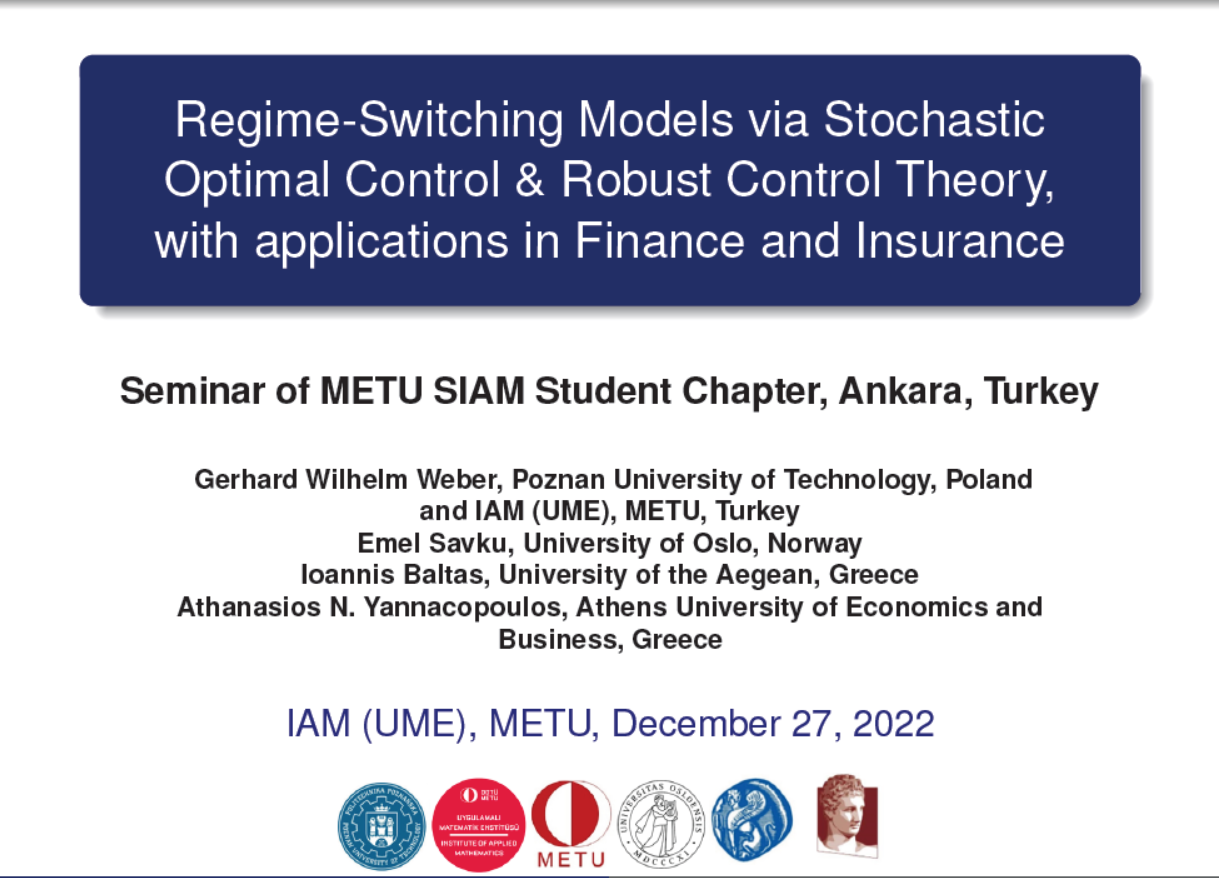

METU-SIAM STUDENT CHAPTER SEMINAR-26

Gerhard Wilhelm Weber, Poznan University of Technology, “Regime-Switching Models via Stochastic Optimal Control & Robust Control Theory, with applications in Finance and Insurance”

Date: December 27, 2022

Time: 15:30-16:30

Place: Online – Zoom Meeting ID

Abstract:

The current presentation is divided into two parts. In the first part, we apply dynamic programming principle to discuss two optimal investment problems by using zero-sum and nonzero-sum stochastic game approaches in a continuous-time Markov regime-switching environment within the framework of behavioral finance. We represent different states of an economy and, consequently, investors’ floating levels of psychological reactions by a D-state Markov chain. The first application is a zero-sum game between an investor and the market, and the second one formulates a nonzero-sum stochastic differential portfolio game as the sensitivity of two investors’ terminal gains. We derive regime-switching Hamilton-Jacobi-Bellman-Isaacs equations and obtain explicit optimal portfolio strategies with Feynman-Kac representations of value functions. We illustrate our results in a two-state special case and observe the impact of regime switches by comparative results. Moreover, such models can be strengthened by time delay, which corresponds to inertia or memory in finance. Furthermore, such models are very strong tools to capture abrupt changes of states. For example, we can apply them to life insurance contracts, where states of a Markov chain can represent a switch from alive to injured or dead. The second part is concerned with the study of the problem of optimal management of defined contribution pension funds, under the effect of inflation, mortality and model uncertainty. To be more precise, we consider a class of employees sharing similar characteristics, who, at the time of their retirement, enter a life assurance contract with the same insurance firm by paying – upfront – an entrance fee. The fund manager of the firm collects this wealth to a portfolio savings account and invests it optimally in a Black-Scholes type financial market, augmented by an inflation-adjusted bond. By resorting to robust control and dynamic programming techniques, we provide: (a) closed-form solutions for the case of the exponential utility function, and (b) a detailed study of the qualitative features of the problem at hand that elucidates the effect of robustness and inflation on the optimal investment decisions.

METU-SIAM STUDENT CHAPTER SEMINAR SERIES-25

Can Eriş, XYZ Technology – Software Developer, “Custody of Blockchain Based Digital Assets”

METU-SIAM STUDENT CHAPTER SEMINAR-25

Can Eriş, XYZ Technology – Software Developer, “Custody of Blockchain Based Digital Assets”

Date: December 13, 2022

Time: 15:30-16:30

Venue: Institute of Applied Mathematics (IAM), Hayri Körezlioğlu Seminar Room (S-212)

Abstract:

The term “digital asset” is defined by the IMF as “digital representations of value, made possible by advances in cryptography and distributed ledger technology. They are denominated in their own units of account and can be transferred peer-to-peer without an intermediary.”

As the digital asset market continues to grow, and individuals and institutions begin to accumulate digital assets that exhibit significant value, the safeguarding of these assets takes on greater priority. Private keys represent the single-point-of-failure in a world of digital assets: they are the only access to an asset, difficult to remember, and are targets for malicious attacks. Losing the private key to an asset is likely to result in the loss of all the respective holdings, with little or no possibility of recovery.

Thus, the main functionality of digital asset custody solutions lies in the safeguarding of private keys — a cryptographic complex alphanumeric combination used to represent, transfer, and operate the holdings. The custody landscape comprises of different options, as well as cryptographic technologies such as multi-party computation that allow shared custodianship of assets that was previously impossible for traditional asset classes.

Institute of Applied Mathematics: 20th Anniversary

Institute of Applied Mathematics: 20th Anniversary

The 20th year of the foundation of Institute of Applied Mathematics (IAM) at Middle East Technical University (METU) is celebrated with a special workshop which will be held on November 4, 2022 in Convention Center at METU.

The workshop will create a platform to present the recent developments in applied mathematics, show its applicability in other disciplines and industry. In line with the content of four graduate programs at IAM, Actuarial Science, Cryptography, Financial Mathematics and Scientific Computing, the experience, needs and future trends will be discussed through invited speakers and participants

METU-SIAM STUDENT CHAPTER SEMINAR SERIES-24

Halil Kolbaşı, Milliman Turkey Country Manager, “Aktüerlik Üzerine”

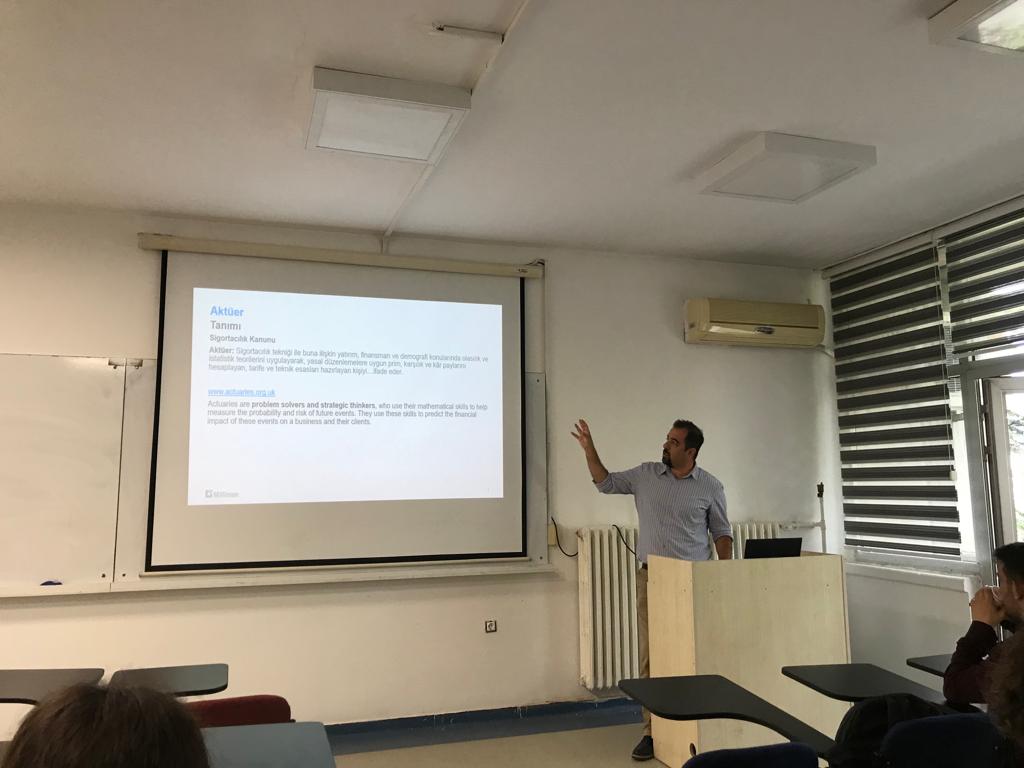

METU-SIAM STUDENT CHAPTER SEMINAR-24

Halil Kolbaşı, Milliman Turkey Country Manager, “Aktüerlik Üzerine”

Date: June 7, 2022

Time: 15:30-16:30

Venue: Institute of Applied Mathematics (IAM), Hayri Körezlioğlu Seminar Room (S-212)

R LECTURE SERIES (ONLINE) – SIAM STUDENT CHAPTER

We have completed our online R Lecture Series, prepared and presented by Dr. Ozan Evkaya in 29-30 November and 1 December, successfully.

If you missed it or want to attend again, you can also find our lectures at METU SIAM Student Chapter Facebook page‘s video playlist.